A National Comp on demand session discusses the connection between behavioral health and physical health and the effects this link can have on an injured worker.

By: Emma Brenner | October 23, 2020

In today’s world, there is no debate about whether mental health is legitimate or not; it is real.

Rather, the discussion is between its connection to physical health and the importance of maintaining the wellbeing of both. At the 2020 National Comp virtual event, one session dove into the importance of this connection and how it relates to injured workers.

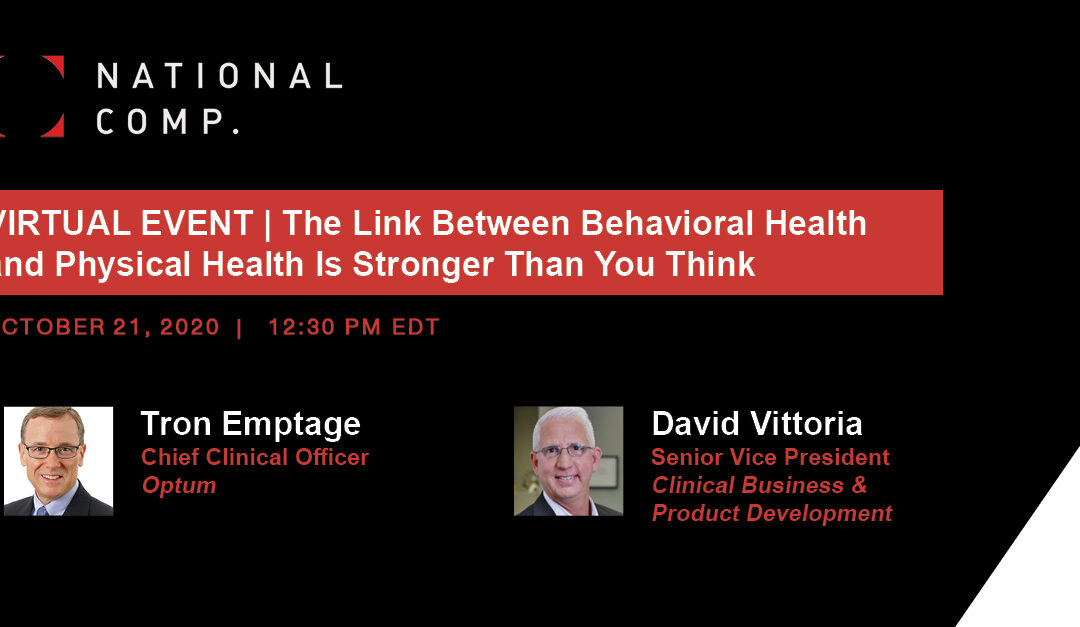

Presented by David Vittoria, senior vice president of Carisk, and Tron Emptage, chief clinical officer of Optum, the session delved into various topics, including the scientific explanation behind the link between physical and behavioral health, substance use and how claims professionals can respond to these risks.

So, What Is the Connection?

The session began with a startling statistic: 60% of patients who experience some sort of physical pain will also experience some sort of mental health challenge as well. These mental health challenges include disorders like depression, anxiety and PTSD.

“It’s not uncommon for injured workers to express depressive symptoms that mirror their physical injury,” Vittoria said.

This could be due to an injured worker, who once reveled in going to work, now feeling isolated recovering at home. The same could be said for a worker who experienced a traumatic injury; there is an increased chance in that worker developing anxiety or PTSD.

The session noted the importance of defining the connection between physical and behavioral health, which is a bidirectional relationship. Vittoria explained that when experiencing physical pain, areas of the human brain are activated that are also closely associated with emotion and vice versa.

“It’s important to note that there is a direct relationship between one’s physical relationship with pain and one’s emotional response to it.”

Creating a Plan and Optimizing Success

From a claims professional and pharmaceutical standpoint, Emptage admitted that adjusters and providers may not always be looking into all aspects of a person’s life, such as their biological, social and physical health, when trying to settle an injured worker’s claim.

To fill that gap, experts have begun to use algorithms and data that take factors from both pharmacy benefit management and behavioral health specialists to conclude if an injured worker is in need of additional mental health benefits.

Once a need for mental health resources or assistance is identified, mental health professionals should then determine the severity of the disorder the worker is suffering from, and then build a care plan to produce the best possible outcome for the worker’s recovery.

Artificial intelligence can’t replace human touch when it comes to behavioral health care, however.

The most critical component is creating a plan directly with the worker. Vittoria noted that while this sounds like a cliché, it is entirely true. The outcomes deemed to be most successful include the worker returning to work fully functioning and the optimization of medication use.

Moving forward, Emptage said there is a benefit to incorporating what Vittoria called “caregiver traits” when filing claims, with the goal of determining how to move the injured workers into their steps to a full recovery.

The attention on behavioral health has been exacerbated throughout the COVID-19 pandemic. The pandemic’s impact has undoubtedly put the wellbeing of many people at risk.

Vittoria added that injured workers can already experience feelings of isolation or sadness when staying home from work, and that’s not in a world of forced isolation and social distancing. Additionally, the forced isolation could lead to the misuse of medication, also increasing the risk of substance abuse or addiction.

“Some will embrace this change and new normal, and others will question it and not know what to do,” Emptage said.

Missed the one-day virtual event? You can watch all the session on-demand here.

Please note: The original article posted by Risk & Insurance can be found here.